Here's the scoop on China's gold demand. According to Bloomberg, the country's economic slowdown is beginning to affect the sector, resulting in a cooling off of gold sales. While jewelry sales experienced rapid growth earlier this year, they only expanded by 24% in May, indicating a slowdown. China, alongside India, is a leading consumer of physical gold, including bars, jewelry, and coins. The surge in sales in March and April was driven by pent-up demand after pandemic restrictions were lifted. However, China's economic growth has been losing steam since the first quarter, with May witnessing a sharp deceleration in industrial output, retail, and investment and record-high youth unemployment. Beijing has introduced direct stimulus measures to combat this slowdown, and the central bank has implemented interest rate cuts to encourage spending. Despite the cooling demand, gold is expected to maintain its elevated level due to geopolitical tensions and recessionary fears, acting as a safe-haven asset.

Foreign central banks have also been stockpiling gold to reduce their dependence on the dollar. China's central bank has accumulated 160 tons of gold in the past seven months, bringing its total holdings to 2,092 tons. Keep an eye on these developments as they unfold in the gold market.

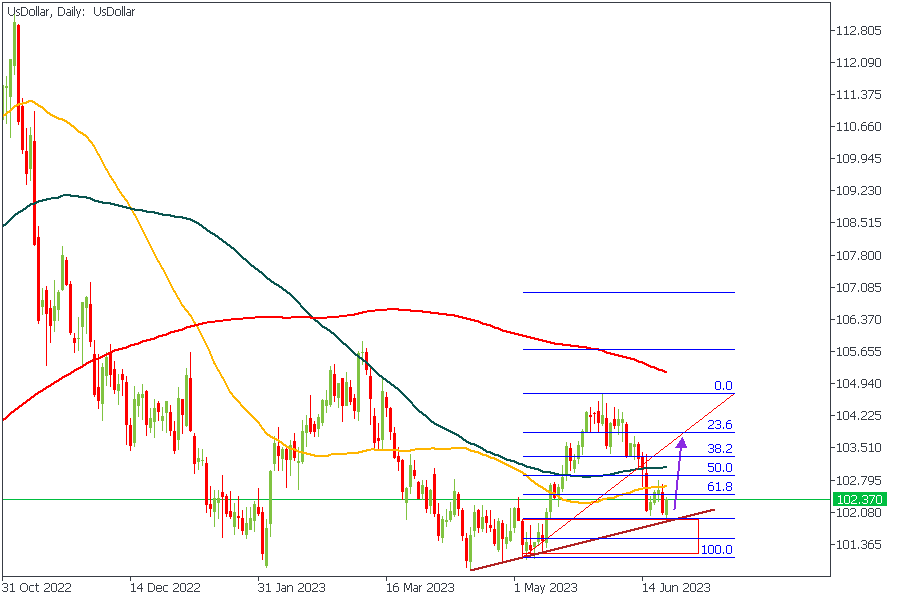

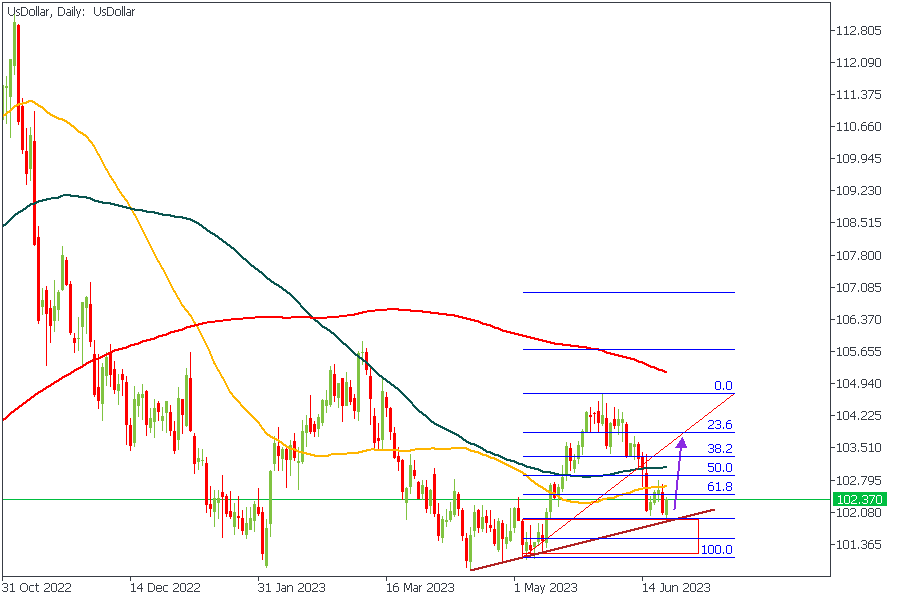

The price action on the US Dollar chart is typical of a bearish reversal. The rejection from the drop-base-rally demand zone coincided with 76% of the Fibonacci retracement. As a result, I expect to see the price reach 38% of the Fibonacci retracement at the very least.

Analyst’s Expectations:

Direction: Bullish

Target: 103.230

Invalidation: 101.856

XAUUSD - Daily Timeframe

Proper price action correlation of the US Dollar and XAUUSD is usually inverse since the Dollar is often used as a security token to hedge against inflation and other economic declines. Since we have seen the technical analysis of the US Dollar indicating a bullish bias, we can expect a further decline in the price of Gold. As discussed earlier, the decline in demand for Gold from China could also contribute to this bearish pressure.

XAUUSD - 4 Hour Timeframe

The price action on the 4-Hour timeframe of XAUUSD reveals that a significant resistance trendline has been broken. In line with this, we can also see that the moving averages are arrayed in a bearish manner, which serves as a confluence. The minor resistance trendline overlaps with the drop-base-drop supply zone and a potential entry area for the bearish market run after the retest of the broken trendline. Despite all these, however, I would still prefer to see a clearer price action from Gold, as opposed to the current shabby movement on the commodity.

Analyst’s Expectations:

Direction: Bearish

Target: 1.26657

Invalidation: 1.28523

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.